Automate the most tedious parts of bookkeeping and get more time for what you love. “It’s not just a cool piece of software, it is giving peace of mind to people.” You deserve to know your taxes aren’t something you have to sweat over the entire calendar year.”

This can help you make bookkeeping a breeze. Wave’s bank payments option (ACH in the US, EFT in Canada) is like paying by cheque, but without the hassle. You’ll get paid faster which saves time for both you and your customers. Online payments allows you to get paid quickly by bank deposit, credit card, and Apple Pay.

Payment solutions for your business

Customers can pay instantly by credit card or Apple Pay when they view the invoice online. Finder monitors and updates our site to ensure that what we’re sharing is clear, honest and current. Our information is based on independent research and may differ from what you see from a financial institution or service provider. When comparing offers or services, verify relevant information with the institution or provider’s site. Talk with a financial professional if you’re not sure. Customers can pay by any major credit card, right from the invoices you send them.

How do I open a Wave Money account?

Confirm details with the provider you’re interested in before making a decision. Want to look more polished, save more time, and conquer cash flow? When I signed up with Wave it was a no brainer. It’s been one of the best decisions I’ve made when it comes to making sure my accounting is on point.

When mobile money succeeded in Kenya, it lifted about a million people out of poverty. And yet, over 10 years later, most Africans still lack access to affordable form 941 mailing addresses are changed ways to save, transfer or borrow the money they need to build businesses or provide for their families. We update our data regularly, but information can change between updates.

Organized and stress-free small business accounting

- With Wave, your invoices and payments automatically flow into your accounting records.

- Dip your Wave Money Visa debit card into 55,000+ free ATMs nationwide.

- Feel confident knowing your financial data is protected by the highest level of certified bank-grade security practices.

- We may receive payment from our affiliates for featured placement of their products or services.

- When your customers use bank payments, you’ll get your money within 1-7 business days1.

- Know when an invoice is viewed, becomes due, or gets paid, so you can stay on top of your cash flow better than ever.

Give customers the option to pay invoices right from their bank account for only 1% per transaction2. When everything is neatly where it belongs, tax time is simple. Wave’s smart dashboard organizes your income, expenses, payments, and invoices.

Wave won’t charge you a fee for using an ATM outside of this network, but the operator might. You can find a free ATM near you in the Wave Money mobile app. Customers can pay instantly by secure bank payment when they view the invoice online. Feel confident knowing your financial data is protected by the highest level of certified bank-grade security practices. “Wave invoicing makes your life a whole lot easier and takes that worry off you. I’ve tried Quickbooks—it’s a bit more complicated and technical, and takes more time to set up.”

Create beautiful invoices, accept online payments, and make accounting easy—all in one place. Finder.com is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions. While we are independent, the offers that appear on this site are from companies from which finder.com receives compensation. We may receive compensation from our partners for placement of their products or services. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect long‐term liabilities defined the order, position or placement of product information, it doesn’t influence our assessment of those products.

You’ll receive the money in your account in 1 business day (Canada), or 2 business days (US)1. Wave uses real, double-entry accounting software. Accountants do, and they’ll thank you for it. With the Pro Plan, impairment definition automatically import, merge, and categorize your bank transactions.

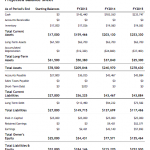

Have an eye on the big picture so you can make better business decisions. Our robust small business accounting reports are easy to use and show month-to-month or year-to-year comparisons so you can easily identify cash flow trends. Connect your bank accounts in seconds with the Pro Plan. Transactions will appear in your bookkeeping automatically, and you’ll say goodbye to manual receipt entry. Give your customers the option of paying with one click using a credit card, bank transfer, or Apple Pay.